Wood Buffalo Recreation Support Program

About

The Wood Buffalo Recreation Support Program is designed to reduce the barriers impacting residents by offering eligible residents affordable access to recreation.

Approved applicants will receive 60% discount on individual and family memberships.

This program is offered at all RMWB facilities and Syncrude Sport & Wellness Centre.

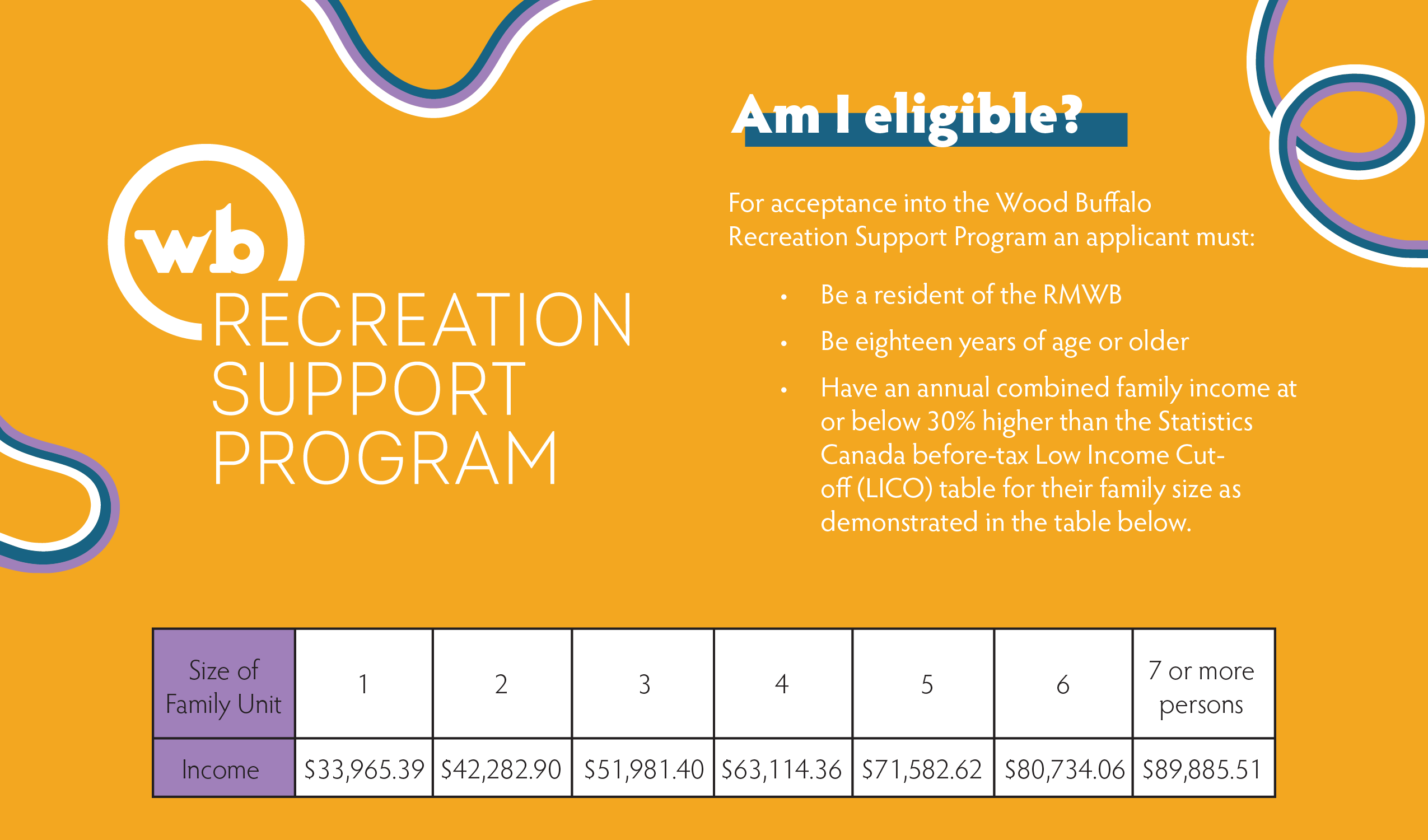

Eligibility

Documentation Required

Applicants must submit the following required documentation along with their completed application form:

-

Verification of Income:

-

Canada Revenue Agency Personal Income Tax Notice of Assessment including address portion. This is not a copy of the personal income tax return. Note: If an applicant cannot submit a copy of their Notice of Assessment, they are encouraged to contact Canada Revenue Agency to request a copy of their “Form C”, OR;

-

Canada Revenue Agency Canada Child Benefit notice (CCB) including address portion. OR;

-

Canada Revenue Agency GST/HST Credit notice including address portion.

-

-

Proof of Residency:

-

Lease or rental agreement, OR;

-

Utility or phone bill, OR;

-

Driver’s License

-

How to Apply

-

The potential program participant will fill out the application form online or in person through Guest Services.

-

Applications will be approved based on program requirements by each location’s designated Guest Services Team Lead and/or Supervisor.

-

Applications will be processed within 2 business days and all applicants will be notified by phone and email confirmation.

-

Confirmation will include the necessary information required to set up the program participant based on membership type.

-

-

Approved program participants will have 90 days from the time of approval to activate their membership at their chosen location. Approved applications that elapse more than 90 days without activation will be void.

- Approval from RRC or the LIFT transit program will be accepted as well.